Do student loans count as income in Canada?

Money from a student loan isn’t considered taxable income in Canada. If you’re a non-resident and not eligible for a SIN because you don’t have a study permit allowing you to work in Canada, you can get an Individual Tax Number (ITN) from the CRA instead.

What counts as foreign income in Canada?

Foreign employment income is income earned outside Canada from a foreign employer. Report your foreign employment income in Canadian dollars. In general, the foreign currency amount should be converted using the Bank of Canada exchange rate in effect on the day it arises.

What income is not taxable in Canada?

lottery winnings, and raffle prizes, unless the circumstances deem that the proceeds are considered income from employment, business or property, or a prize for achievement. For instance, prizes from employer-promoted contests could be considered employment income.

What is Canadian non-taxable income for OSAP?

Canadian non-taxable income/foreign income includes the following: • income earned in a country other than Canada (employment income, rental income or gains from investments); • child support received; • income earned on a First Nations Reserve in Canada; • lottery winnings totalling over $3,600; • gifts and …

Is a loan considered income in Canada?

Taxable situation If the full principal of the loan is not repaid within 60 days, the interest benefit is taxable. You will need to report this amount on a T4 slip in the year the loan is received. If the interest benefit is not taxable, you do not need to do any calculations.

Do students pay income tax in Ontario?

Yes, students in Canada are required to pay income taxes on their taxable income every year.

What happens if you don’t report foreign income in Canada?

The penalty for failing to file any of the foreign reporting information returns is the greater of either $100 or $25 per day for each day that the return is late (maximum of $2,500).

What is considered other income in Canada?

Tax Tip: Other income can include income that: Isn’t reported on an information slip (such as a T4, T4A, or RL-1) or. Hasn’t been entered on the T936: Calculation of Cumulative Net Income Loss (CNIL) or Other scholarships, grants, or bursaries page.

What is considered active income in Canada?

BUT WHAT IS ACTIVE BUSINESS INCOME? Simply, “Active business” is defined by the Income Tax Act to be a business that is carried on by a Canadian resident taxpayer that is not one of two types of business. The first type that doesn’t qualify is a “specified investment business”.

How much income can go unreported in Canada?

You may have to pay a federal and provincial or territorial penalty if you fail to report an amount of $500 or more on your: 2023 tax return.

How much income in Ontario is tax free?

The Ontario Basic Personal Amount was $11,865 in 2023. For 2024, the basic personal amount is increasing to $12,399. If you make less than $12,399, then you are exempt from Ontario’s provincial income tax. You may still need to pay EI premiums and make CPP contributions.

What is considered as low income in Canada?

Following the practice of many international organizations, Statistics Canada began to publish Low-income measure-based thresholds (LIMs) in 1991. The concept underlying the LIM is that all persons in a household5 have low income if their adjusted household income falls below half of the median adjusted income.

What is considered foreign income in Canada?

Foreign employment income is the amount you earned outside of Canada from a foreign employer. If you paid income tax to a foreign country, do not reduce it from your foreign income when reporting it on your Canadian tax return.

Are bursaries taxable income in Canada?

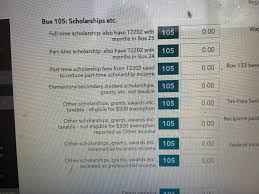

Elementary and secondary school scholarships and bursaries are not taxable. A post-secondary program that consists mainly of research is eligible for the scholarship exemption, only if it leads to a college or CEGEP diploma, or a bachelor, masters, or doctoral degree (or an equivalent degree).

Do non residents pay income tax in Canada?

Your tax obligations. As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive. Generally, Canadian income received by a non-resident is subject to Part XIII tax or Part I tax.

Do student loans count as income Canada?

The Ontario Student Assistance Program (OSAP) offers student loans and grants to help pay for school. You have to pay back OSAP student loans, while grants are money you don’t have to repay. When you file your taxes, you include any OSAP grants as income, but not your student loans.

Are OSAP grants taxable in Canada?

OSAP grants are non-taxable for full-time students who meet the eligibility criteria. For part-time students, the part of the grant related to the study period is tax-free, according to income tax laws.

Do loans appear on income statement?

Only the interest portion of a loan payment will appear on your income statement as an Interest Expense. The principal payment of your loan will not be included in your business’ income statement.

Does an international student have to pay income tax?

Filing taxes as an international student is required for all F-1 visa holders, even if you decide not to work while pursuing your education. Don’t let questions about Social Security numbers and tax forms intimidate you. It’s easy to file your F-1 student tax return with a little bit of prep work.

How many years can you go without filing taxes in Canada?

According to the collections limitation period (CLP) for individual tax, the CRA has 10 years to collect a tax debt. After that period, the CRA can not take any further action to collect the debt, but the debt is still outstanding.

Can international students get a tax return for tuition in Canada?

Filing an international student tax return in Canada If you are an international student with Canadian source income or are considered a resident, then you can claim tuition credits and are eligible for benefits such as the harmonised sales tax credit.

What is the 90% rule in Canada?

What is the 90% rule for non-residents in Canada? If you have recently arrived or returned to Canada you may be entitled to full non-refundable tax credits if you meet the 90% rule. The 90% rule refers to at least 90% of a non-residents income from the tax year being sourced in Canada.

Does Canada track foreign income?

Do I have to declare foreign income in Canada? Whether you live in Canada or are a deemed resident of Canada who lives in another country, you have to report all of your international income on your return. However, you may be able to claim a credit for any foreign tax you have paid on your income.

Does foreign income count as income?

Total Income Includes Both Earned and Unearned Income The amount you are taxed on includes earned income and unearned income from foreign and non-foreign sources.

How much foreign income is tax free in Canada?

Basically, you are allowed earn up to $15,000 tax free in the tax year if 90% or more of your total income was sourced in Canada. If you earned more than 10% outside Canada, you won’t be eligible to earn any tax free income up to a total amount of $15,000.

Do e-transfers count as income in Canada?

The etransfer in and of itself is not a taxable event normally. Nor is it reported by a bank to the Canada Revenue Agency. If the money involved is from employment, the gross earnings and deductions applied will be recorded by the employer and reported to the separately to the Canada Revenue Agency.

How much do students get back in taxes in Canada?

This credit equals 15%* of the amount paid in tuition fees during one year. For example, a student who has paid $3,000 in tuition fees can receive a $450 credit. *Calculated by multiplying the tuition by the rate of the lowest federal tax bracket for the current year. This has been 15% since 2006.

What is the average student loan debt in Canada?

The average student loan debt in Canada is approximately $28,000. The total amount of student loan debt in Canada is more than $23.5billion. Women make up the majority of Canada student loan debt borrowers. 20-to-24-year-olds hold the most student loan debt.

Are student loans interest free in Canada?

Canada Student Loans | Permanent Elimination of Interest The Government of Canada permanently eliminated the accumulation of interest on all Canada student loans including loans currently in repayment as of April 1, 2023.

What are occasional earnings in Canada?

If you earn casual income (e.g., for babysitting or doing odd jobs) you can report it as “Occasional earnings” in the Tips, Royalties, Occasional Earnings, etc. section. That said, if you earn a substantial amount of money, chances are you are either earning: business income and should report it on a T2125, or.

Do OSAP grants count as income?

Are OSAP loans taxable income?

Do OSAP grants increase tax owing position?

How do I calculate my taxable income for OSAP 2021-22?

The short answer is no, OSAP itself doesn’t directly count as income. It’s considered a student loan and not a source of income. But hold on, there’s more to it.

OSAP and Taxes:

Think of OSAP as a helping hand, a loan to help you get that education. You’ll eventually have to repay it, but it doesn’t magically turn into taxable income just because you’re using it for living expenses.

However, here’s where things get interesting: you might have to pay taxes on any interest earned on your OSAP loan. The interest accumulates over time, and you’ll need to report it on your tax return. But remember, the interest earned on OSAP is taxable income, not the actual loan itself.

OSAP and Benefits:

Now, let’s talk about benefits. If you’re thinking about applying for government benefits like Employment Insurance (EI) or Canada Child Benefit (CCB), you might wonder if OSAP impacts your eligibility. The truth is, it’s a little complex.

While OSAP isn’t considered income for EI or CCB purposes, your overall financial situation plays a key role. If you’re receiving OSAP and already have a job, your earnings from that job will be considered when determining your eligibility for EI or CCB.

So, it’s not necessarily OSAP itself that matters for benefits, but your overall financial picture. If you’re unsure, it’s best to contact the relevant government agency directly for personalized guidance.

OSAP and Loans:

Here’s the thing about applying for loans: it’s not that simple. Most lenders will look at your overall financial situation, including your income, debt, and credit history, when evaluating your loan application.

Even though OSAP isn’t income, it’s still a liability. The amount of your OSAP loan will contribute to your overall debt load, which can affect your loan approval and interest rates.

Let’s say you’re applying for a car loan. A lender might consider your OSAP as a factor, even though it isn’t directly income. They might view it as an additional financial burden, especially if you’re also working and have other debts.

OSAP and Credit Score:

While OSAP isn’t income, it can have a indirect impact on your credit score. How? Well, if you miss payments on your OSAP, it can hurt your credit score. This can make it harder to get loans in the future, as lenders often use credit scores to assess your financial trustworthiness.

Think of it like this: a good credit score is like a good report card. It shows lenders you’re responsible with money, making it easier to get approved for loans with better terms. A bad credit score is like a failing grade, potentially putting you at a disadvantage.

OSAP and Your Financial Picture:

The bottom line is, while OSAP isn’t directly counted as income, it’s an important part of your financial picture. It can impact your loan applications, your eligibility for benefits, and even your credit score.

Here’s a quick recap:

OSAP is a student loan, not income.

Interest earned on OSAP is taxable income.

OSAP doesn’t directly affect eligibility for benefits like EI or CCB, but your overall financial situation does.

OSAP can affect your loan applications and credit score.

Always remember, it’s better to be safe than sorry. If you’re unsure about how OSAP impacts a specific situation, reach out to the relevant organization or a financial advisor for personalized advice.

FAQs:

Q: If OSAP is not considered income, how do I pay it back?

A: You will eventually need to pay back your OSAP loan, including the original amount you borrowed plus accumulated interest. The repayment period typically begins six months after you graduate, leave school, or drop below a certain course load. You can make monthly payments through the Ontario Student Assistance Program (OSAP) website or through your chosen repayment plan.

Q: Can I use OSAP to buy a house?

A: OSAP is not considered income, so it generally won’t be taken into account when applying for a mortgage. However, your overall debt load, including your OSAP loan, could impact your ability to get a mortgage.

Q: Can I deduct OSAP interest payments from my taxes?

A: Generally, you cannot deduct OSAP interest payments from your taxes. However, there might be some exceptions, depending on your specific circumstances. You should consult with a tax advisor to understand your specific situation.

Q: Can I claim OSAP on my tax return?

A: You generally don’t claim OSAP on your tax return. You’ll only need to report the interest earned on your OSAP loan. However, you may be able to claim certain education-related expenses, like tuition fees, on your tax return.

Q: If I’m getting OSAP, do I have to report it to my bank?

A: It’s generally not mandatory to report your OSAP to your bank. However, it’s always a good idea to be transparent about your finances. If you’re applying for a loan or credit card, be prepared to share all relevant financial information, including your OSAP.

Q: What if I’m receiving OSAP and I’m not sure if I’m working enough to qualify for EI?

A: It’s always best to contact Service Canada directly to discuss your eligibility for EI. They can provide personalized guidance based on your specific circumstances.

Q: What if I can’t afford to pay back my OSAP loan?

A: If you’re struggling to make your OSAP payments, contact the Ontario Student Assistance Program (OSAP) to discuss your options. They offer various repayment plans and might be able to help you find a solution that fits your situation.

Remember, seeking financial advice is a smart move. If you’re unsure about how OSAP impacts your situation, consult with a financial advisor or the relevant government agency for personalized guidance.

See more here: What Counts As Foreign Income In Canada? | Does Osap Count As Income

Solved: Are OSAP grants considered taxable income?

Are OSAP grants considered taxable income? If your son was a full-time student, it may be just an issue with which box the T4A income is being assigned during the Auto-fill. To correct this, return to the T4A screen for the higher income and move the entry for box TurboTax® Support

Income details – Ontario Student Assistance Program

Income details Include money received through: employment income; government funding or income support provided directly to you ; awards, scholarships, fellowships, bursaries gov.on.ca

Is OSAP (Student Loans) Considered Taxable Income?

OSAP loans are not taxable income and do not need to be reported on your tax return. Grants or bursaries in addition to the loan may be considered taxable income. PiggyBank

Report your scholarship or grant income – Help Centre

If you received an OSAP grant (box 105 of a T4A), you’ll need to report it as either full-time or part-time scholarship income. These grants are not the same as your student wealthsimple.com

Is OSAP considered taxable income? :

You have to report it but it isn’t considered taxable. Because in Line 236, which gives the net income, it only shows my employment income. Reddit

How Student Loans Are Considered for Taxes

Does OSAP count as income on my tax return? Student loans received from OSAP don’t count toward your total taxable income when you file your taxes. Any OSAP grants received, however, are TurboTax® Canada

Student banking 101: Filing taxes | Posts – Scotiabank

The short answer is yes. If you live in Canada and have taxable income, you must pay income taxes. Examples of taxable income include: Employment income from a full-time or part-time job. Tips, scotiabank.com

Parent’s total gross yearly income – Ontario Student Assistance

Despite being exempt from tax, these earnings are still considered income for the purposes of determining eligibility for grants and loans through OSAP and must be included in the gov.on.ca

How to Estimate your income – Ontario Student Assistance Program

How to Estimate your income. 2021-22 OSAP Application for Full-time Students. You can estimate your taxable income by taking the total gross income you have received to gov.on.ca

OSAP Income & Asset Update – Reference Guide

Income – Study Period and Prior Year. Students are expected to report earned income, as well as other sources of income, received during the study period if the total gross utoronto.ca

See more new information: charoenmotorcycles.com

How Osap Works

How I Made Thousands Of Dollars From Osap Student Loans \U0026 Application Process Explained

What Every Student Needs To Know About Osap (Student Loans Explained) | Avoiding Student Debt Canada

3 Tips You Need To Know About Osap | Humber College

How Do I Know My Osap Was Approved?

Student Loan Repayment: Everything You Need To Know About The Canada Student Loan \U0026 Osap

Osap 2024- 2025- Start Your Application

How Does Osap Work?

How Much Student Loan Debt Do You Have? 💸 #Shorts

Link to this article: does osap count as income.

See more articles in the same category here: https://charoenmotorcycles.com/how