How do you calculate EBIT EPS indifference point?

To calculate the level of EBIT where EPS remains stable, simply input the debt interest, current EPS and updated shares outstanding values and solve for EBIT: ($10.50 x 20,000) + 0 ÷ (1 – 0.3) + $500 = $300,500. Under this financing plan, the company must more than double its earnings to maintain a stable EPS.

How do you calculate the indifference point?

The following formula is used to calculate a cost indifference point. To calculate the Cost Indifference Point, divide the differential fixed costs by the differential variable costs per unit.

How to calculate EBIT from EPS?

It’s calculated as Gross Operating Income (total sales) minus Operating Expenses (business costs). EBIT represents your underlying profit potential, untainted by any financial leverage. Let’s factor in the cost of your debt. Multiply the loan amount by the annual interest rate to determine the annual interest expense.

How to calculate EBIT break even point?

EBIT Breakeven is calculated by finding the point where alternative financing plans are equal according to the following formula: (EBIT – I) x (1.0 – TR) / Equity number of shares after implementing financing plan. I: Interest Expense TR: Tax Rate Formula assumes no preferred stock.

What is an EBIT-EPS indifference analysis used for?

An EBIT-EPS indifference analysis chart is used for: Evaluating the effects of business risk on EPS. Examining EPS results for alternative financial plans at varying EBIT levels. Determining the impact of a change in sales on EBIT.

How do you calculate EBIT formula?

EBIT = Revenue – COGS – Operating Expenses COGS – represents the cost of goods sold, including equipment, raw materials, employee labor, and shipping. Operating expenses – this refers to running costs like rent, corporate salaries, marketing, insurance, and equipment.

What is indifference point formula in capital structure?

Calculating the indifference point involves setting up and solving equations that equate the EPS under different financing scenarios. The result is the EBIT level at which the two options yield the same EPS, making the company indifferent to choosing either option.

What is the formula for the indifference point of supply chain?

The indifference formula looks like this: P1(X) + P2(Y) = I. “P1” is the first product. “P2” is the second product. “X” and “Y” represent the prices of each product.

What is indifference price point?

Indifference price point (IPP) The point at which the proportion of customers who believe that the price is becoming too expensive is the equivalent to the proportion of customers who feel the price is a bargain. At this point, most customers are indifferent to the price.

What is EBIT-EPS chart?

The EBIT-EPS approach to capital structure is a tool businesses use to determine the best ratio of debt and equity that should be used to finance the business’ assets and operations. At its core, the EBIT-EPS approach is a way to mathematically project how a balance sheet’s structure will impact a company’s earnings.

How to calculate EBIT calculator?

EBIT = Total revenue – Cost of goods sold – Operating expenses. EBIT = Net income + Taxes + Interest.

What is EBIT-EPS leverage?

Fundamental analysis uses degree of financial leverage (DFL) to determine the sensitivity of a company’s earnings per share (EPS) when there is a change in its earnings before interest and taxes (EBIT). When a company has a high DFL, it generally has high interest payments, which negatively impact EPS.

What is an indifference point?

An indifference point is a point where the EPS of plan 1 is equal to the EPS of plan 2 or it has the same level of EBIT. EBIT-EPS analysis involves comparing alternative methods of financing and their impact on earnings. When making financial decisions, companies have many options.

How do you calculate EPS?

EPS equals the difference between net income and preferred dividends, divided by the average number of outstanding common shares. EPS is sometimes known as the bottom line of a firm’s worth. The earnings per share figure can help investors gain an idea of a company’s financial performance.

How do I calculate break-even point?

Revenue is the price for which you’re selling the product minus the variable costs, like labor and materials. To calculate your break-even point in units, use the following formula: Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit).

What is the point of indifference of EBIT?

it refers to that EBIT level at which EPS remains the same irrespective of the debtequity mix. In other words, at this point, rate of return on capital employed is equal to the rate of interest on debt. This is also known as break even of EBIT for alternative financial plans.

What is the difference between financial break even point and indifference point?

Looks like the indifference point focuses on cost and pricing to do pricing analysis. Break even is about the total business and finding your point to break even. Example: You have a startup and you know the costs tonstsrt up.

What are the disadvantages of EBIT-EPS analysis?

Following are the limitations of EBIT-EPS analysis: EBIT-EPS analysis does not consider the risk factor. Risk level increases when the level of debt increases because there is an obligation to pay the interest and principal amount after a certain period.

Why do we calculate EBIT?

Earnings before interest and taxes (EBIT) measures a company’s net income before income tax and interest expenses are deducted. EBIT is used to analyze the performance of a company’s core operations.

How is EBIT multiple calculated?

Next, the EV/EBIT multiple can be calculated by dividing the enterprise value (EV) by the EBIT, which we’ll complete for each company in order from left to right. Note how the initial EV/EBIT multiples are not too different for the first two companies, as those two companies are less capital-intensive.

What is the relationship between EBIT and EPS?

EBIT measures operating profitability, while EPS assesses earnings on a per-share basis. By examining these metrics and their trends over time, investors and analysts can make informed decisions about a company’s investment potential and financial strength.

Are the indifference levels of EBIT different capital plans have?

At indifference level of ebit different capitals have Indifference Earnings Before Interest & Taxes (Indifference EBIT) is the point of the capital structure where the corporation does not care about whether they issue new debt, have no debt and 100% equity or have a combination of both debt & equity.

What is the indifference point in the make or buy decision?

The indifference point is that point where the cost of making is equal to the cost of buying. If a company expects to produce fewer units than this indifference point, then they should choose to buy instead of making as it would be more cost-effective and profitable.

What is indifference point in cost of capital?

Cost indifference point is the point where the total cost of the two alternatives is equal. It can also be defined as the EBIT level above which the benefits of leverage operate in relation to earnings per share. The debt should be included into capital structure.

What is the mathematical formula for the indifference curve?

In algebraic terms, if we rewrite the equation of an indifference curve U(t, y)=c in the form y=g(t, c), then g(t, c) is a decreasing and convex function of t for given c.

How do you calculate EV to EBIT?

The formula for calculating the EV/EBIT multiple is as follows. Where: Enterprise Value (TEV) = Equity Value + Net Debt + Preferred Stock + Controlling Interests (NCI) EBIT = Gross Profit — Operating Expenses (OpEx)

What is EBIT corresponding to financial indifference point?

Indifference points refer to the EBIT level at which the EPS is same for two alternative financial plans. According to J. C. Van Home, ‘Indifference point refers to that EBIT level at which EPS remains the same irrespective of debt equity mix’.

What is the formula for the break-even point?

To calculate the break-even point in units use the formula: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit) or in sales dollars using the formula: Break-Even point (sales dollars) = Fixed Costs ÷ Contribution Margin.

How do you calculate EBIT percentage change?

After calculating the EBIT, find the percent change in EBIT with the following formula:% of change in EBIT = (current EBIT – previous EBIT) / (previous EBIT) x 100 =Using the cellphone case business as an example, calculate the percent change in EBIT using the current value of $56,000 and a previous EBIT of $54,400:% …

What is indifference point in EBIT-EPs analysis?

What is the difference between EPs and EBIT indifference points?

What is the indifference level of EBIT?

What is the equivalency point (point of indifference) of EBIT?

Hey there, fellow finance enthusiasts! Let’s dive into the EBIT-EPS indifference point calculator, a handy tool for making savvy financial decisions.

What is the EBIT-EPS Indifference Point?

Think of it as the point where your earnings per share (EPS) remain the same regardless of whether you choose debt financing or equity financing to fund your operations. It’s like a magic number that helps you decide which financing option aligns best with your company’s goals.

Why Do We Need It?

We use this calculator because different financing strategies impact your EPS in different ways. Debt financing typically comes with interest payments, which reduce your net income. Equity financing, on the other hand, involves dividing profits amongst more shareholders, also affecting your EPS.

Here’s how it works:

* EBIT: Earnings Before Interest and Taxes. This represents your company’s operating profitability before factoring in financing costs.

* EPS: Earnings Per Share. This measures your company’s profitability per share outstanding.

The Indifference Point:

This point is where the EPS generated by debt financing equals the EPS generated by equity financing. At this point, you’re financially indifferent to choosing one over the other.

How to Calculate It

Here’s the formula for finding your EBIT-EPS indifference point:

EBIT = (Fixed Costs + Preferred Dividends) / (1 – Tax Rate)

Let’s break down each element:

* Fixed Costs: Costs that remain constant regardless of your production or sales volume. These include rent, salaries, and depreciation.

* Preferred Dividends: Dividends paid to preferred shareholders. These are usually fixed payments.

* Tax Rate: The percentage of your income that goes to taxes.

Here’s a quick example:

Let’s say your company has $100,000 in fixed costs, pays $10,000 in preferred dividends, and has a tax rate of 30%. Using the formula, we calculate the indifference point:

* EBIT = (100,000 + 10,000) / (1 – 0.30)

* EBIT = 110,000 / 0.70

* EBIT = $157,143

Interpreting the Results

Now, this $157,143 EBIT is your magic number! If your company’s EBIT is *above* this amount, debt financing would likely be more beneficial as it would result in higher EPS. But if your EBIT is *below* this amount, equity financing would likely be the better choice.

The Power of the Calculator

This calculator empowers you to make informed decisions about your financing strategy. By analyzing different scenarios and comparing EPS under both debt and equity financing, you can make the choice that optimizes your company’s financial performance.

Beyond the Basics: Factors to Consider

While the EBIT-EPS indifference point is a valuable tool, it’s not the only thing to consider. Factors like:

* Risk Tolerance: How comfortable are you with taking on debt?

* Financial Flexibility: How much financial wiggle room do you need?

* Debt Covenants: Are there any restrictive covenants associated with debt financing?

* Cost of Capital: What’s the cost of debt versus the cost of equity?

These factors can influence your decision even if the indifference point suggests otherwise.

Frequently Asked Questions

Q1: How do I find an EBIT-EPS Indifference Point calculator?

Many financial calculators and spreadsheet programs can calculate the EBIT-EPS indifference point. You can also find online calculators specifically designed for this purpose.

Q2: What if my company doesn’t have preferred stock?

If your company doesn’t have preferred stock, you can simply exclude the preferred dividends part of the formula.

Q3: How do I know if my company’s EBIT is above or below the indifference point?

You can estimate your EBIT using historical data or projected financial statements. Compare your estimated EBIT with the calculated indifference point to see which financing strategy is more advantageous.

Q4: Can this calculator help me decide between issuing bonds or stock?

Absolutely! This calculator helps you understand the impact of different financing choices on your EPS. By analyzing the EPS under both bond and stock issuance scenarios, you can make an informed decision based on your company’s specific circumstances.

Q5: What happens if my company’s EBIT is exactly at the indifference point?

If your company’s EBIT is exactly at the indifference point, it implies that both debt and equity financing would result in the same EPS. In this case, you might consider other factors, such as risk tolerance, financial flexibility, or cost of capital, to make the final decision.

Remember, the EBIT-EPS indifference point calculator is a powerful tool that can help you make informed financial decisions. By using it and considering other relevant factors, you can maximize your company’s profitability and financial flexibility.

See more here: How Do You Calculate The Indifference Point? | Ebit Eps Indifference Point Calculator

Calculation of Point of Indifference | Capital Structure

This chart shows the expected earnings per share (EPS) at various levels of earnings before interest and tax (EBIT) which may be plotted on a graph and straight line Accounting Notes

How to Calculate the EBIT-EPS Indifference Point | Bizfluent

Calculate the EBIT-EPS Indifference Point. Calculate the total amount of any interest expense associated with each financing plan. To do so, multiply the interest Bizfluent

How Do You Find the Level of EBIT Where EPS Doesn’t

To calculate the level of EBIT where EPS remains stable, simply input the debt interest, current EPS and updated shares outstanding values and solve for EBIT: Investopedia

Indifference Point | Capital Structure | Calculation of EBIT – EPS …

Here is the video about Indifference point Calculation of EBIT – EPS in Capital Structure Playlist Capital Structure: https://youtube.com/playlist?list=PLab… YouTube

EBIT Calculation | Step by Step Guide to Calculate EBIT (with

EBIT determines a company’s profitability. Its calculation dedicates the cost of goods sold and operating expenses. The income statement formula is Earnings Before WallStreetMojo

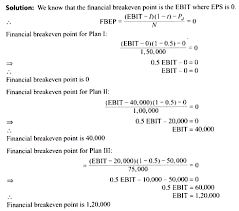

EBIT – EPS Analysis solved problems Financial

Calculate the EPS under all the three financing options indicating the alternative giving the highest return to the equity shareholders. Also determine the indifference point between the RBL Academy

EBIT-EPS Analysis in Leverage: Concept, Advantages and Other

Indifference points refer to the EBIT level at which the EPS is same for two alternative financial plans. According to J. C. Van Home, ‘Indifference point refers to that EBIT level Your Article Library

How to Calculate Indifference Point?

Method 1. Under the first method, we use differential fixed costs and differential variable costs per unit to come up with the indifference point. We simply divide the differential fixed costs by the eFinanceManagement

EBIT Calculator – Earnings Before Interest and Tax – DQYDJ

EBIT, or Earnings Before Interest and Tax, is an alternative measure of earnings that adjusts for a company’s capitalization and tax jurisdiction. It is useful in comparing a DQYDJ

See more new information: charoenmotorcycles.com

Indifference Point | Capital Structure | Calculation Of Ebit – Eps | Verification | Kauserwise

Ebit Eps Indifference Point

#2 Ebit – Eps Analysis (Earning Per Share) – Financial Management ~ B.Com / Bba / Cma

Indifference Point In Capital Structuring

Indifference Point Calculation

Ebit – Eps ( Indifference Point) How To Calculate Ebit Of Two Plan At Indifference Level/Point.

Eps-Ebit Analysis

Indifference Point \U0026 Eps ।। Bba 4Th Year Accounting \U0026 Management Suggestion 2023

How To Compute Indifference Point In Financial Management | Illustration | Ca Inter |May 24 |Nov 24

Link to this article: ebit eps indifference point calculator.

See more articles in the same category here: https://charoenmotorcycles.com/how